ES had a gap and go. As I am still having a great deal of my time taken by a family members illness I am going over the major points of the day.

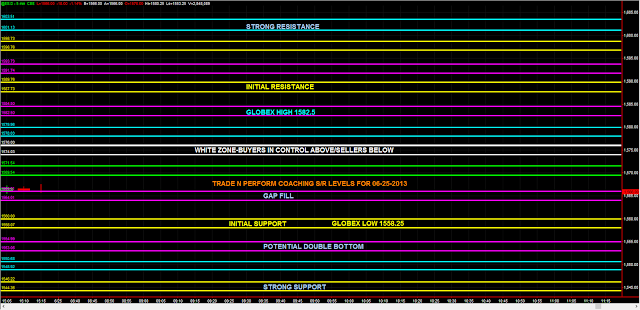

THE WHITE ZONE WAS 1609.50-1612. The WHITE ZONE determines who has control; buyers above & sellers below. The questions was not did sellers have actual control, we had a huge gap down, there was clearly highly motivated sellers. The question was which way to lean, Unless buyers could push above 1612, sellers had the upper hand. This tells you the down side rotations should be stronger than upside rotations & if your going to get long, choose wisely and don't hang around too long.

If you will look at each zone, the first push down into a zone provided a nice rotation up at almost every level even though sellers had control, conversely, pushes up were met with excellent shorting opportunities; particularly with the first touch of either side of the zone (front & back)

I pointed out that if we got tick divergence at about 9.30 am central time that it would be a good set up. At 940 am ES reversed on tick divergence for a 6 point rotation higher. Tick divergence again occurred right at the front of the 1190.50-1592.50 for a 10 point rotation up.

When the market is so stretched you have to look for opportunities for reversals.

1601-1603 ZONE was big and when buyers were unable to push above the fate was sealed.

I pointed out that on the push up to the 1601-1603 zone I was selling in the money Binary Calls for downside exposure. I was able to cover the calls for 5 bucks and they expired worthless. Creativity and limiting risk is a big part of being a successful trader. You have to look at all the ways you can ring the registrar within your frame work.

Finally I pointed out repeatedly through the coarse of the day, can you imagine a big reversal? The point isnt that I knew there would be a reversal. I did not. The point was I am open to the potability. Mental flexibility is key. You have to be able to imagine the possibilities and still be comfortable not knowing what will happen.

I hope that helps some traders out there. Becoming a true pro requires a multi dimensional approach with discipline and flexibility to see both sides of an opportunity.

Great crazy day. So many good opportunities. Hope everyone banked. I know my coaching clients did well and that is very satisfying.

Goodnight. More fun tomorrow.

Notice: This Blog & its contents are intended to be for educational purposes only & not to be construed as trading recommendations in any way. You should not follow anyone blindly. Trading Futures & Options on Futures involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions are subject to change at any time.